ESG Data Management That Strengthens Brands Through Transparency

Ask fashion brands what the March 2024 rollout of the Corporate Sustainability Reporting Directive (CSRD) means for their reporting, and not many, if any, of the 50,000 companies no required to disclose ESG performance across their operations are likely to be enthusiastic.

Sure, we can all agree that transparency in fashion has become a metric of brand value, investor confidence, and consumer trust. And that data — specifically, ESG data — has transformed from a backend reporting task to a compliance standard with clear business implications.

But, in practice, the picture looks different — and bleak. Many brands are still stuck managing fragmented ESG data across spreadsheets, siloed supplier portals, and outdated ERP systems, with little confidence in the quality, traceability, or audit-readiness of what they’re reporting.

The stakes are high, and non-compliance's consequences go beyond fines and slaps on the wrist. Rather, they obscure access to meaningful data and make it nearly impossible to measure progress, detect supplier violations, or prove sustainability claims that now extend to Scope 3 emissions and social risks embedded deep within a brand’s supply chains.

In this article, we’ll explore how effective ESG data management empowers fashion brands to meet today’s regulatory and reputational demands while building a stronger, more resilient business for tomorrow.

Why ESG Data Management Is Essential for Fashion Brands

In a world where sustainability claims are increasingly scrutinized, ESG data management must be treated as a strategic capability — one that drives accountability, de-risks supply chains, and unlocks new forms of business value.

But this is easier said than done. As reported on in an article by Supply & Demand Chain Executive, “The challenges of ESG compliance often stem from fragmented systems and data silos, creating significant obstacles for companies striving to achieve transparency and accountability.”

And that’s just one “face” worn by the problem. ESG managers face significant challenges in the fashion context, including:

-

Overwhelming supplier data requests: Suppliers are inundated with diverse and often conflicting ESG data requests from multiple brands, leading to reporting fatigue and potential inaccuracies.

-

Inconsistent data quality and verification: Even when data is collected, ensuring its accuracy and reliability remains a significant hurdle. The lack of verification mechanisms can lead to greenwashing and erode stakeholder trust.

-

Regulatory complexity and compliance burden: The proliferation of ESG regulations across different jurisdictions adds layers of complexity to compliance efforts, requiring brands to stay abreast of varying requirements and timelines.

These challenges point to a very clear conclusion: the context we’re all operating in now means fashion brand ESG managers will need to go beyond annual reporting and adopt a continuous, systemized approach to ESG data that’s auditable, verifiable, and actionable.

But there are opportunities for improvement that are opened up by these exact challenges:

-

Adopting digital traceability tools: Implementing advanced digital platforms can streamline data collection, enhance traceability, and improve overall ESG performance.

-

Collaborative supplier engagement: Building strong partnerships with suppliers and providing them with the necessary tools and training can lead to more accurate and consistent ESG data reporting.

-

Integration of ESG data into core business strategies: Embedding ESG considerations into the core business strategy ensures that sustainability efforts are aligned with overall company goals, leading to more cohesive and effective initiatives.

-

Leveraging AI and advanced analytics: Utilizing artificial intelligence and advanced analytics can enhance data accuracy, identify trends, and provide actionable insights for continuous improvement.

And there are definitely brands putting these ideas into practice. Here’s how they’re approaching it.

First, robust management requires unifying ESG data with operational data — emissions, labor, water use, and more — across all business functions, not just within the sustainability team.

Brands like Hugo Boss, for example, have integrated sustainability KPIs into financial reporting frameworks, aligning ESG performance with executive compensation. This moves ESG out of the realm of “CSR” and into the core of strategic decision-making.

"Companies need to invest in technology and processes to improve data management, actively engage with stakeholders to refine materiality, and carefully consider the implications of different reporting standards." — Sustainability Directory

Second, robust ESG data management demands standardization and interoperability. This is where industry-aligned taxonomies (like those from the Textile Exchange or Higg Index) become essential, especially for aggregating data from diverse suppliers.

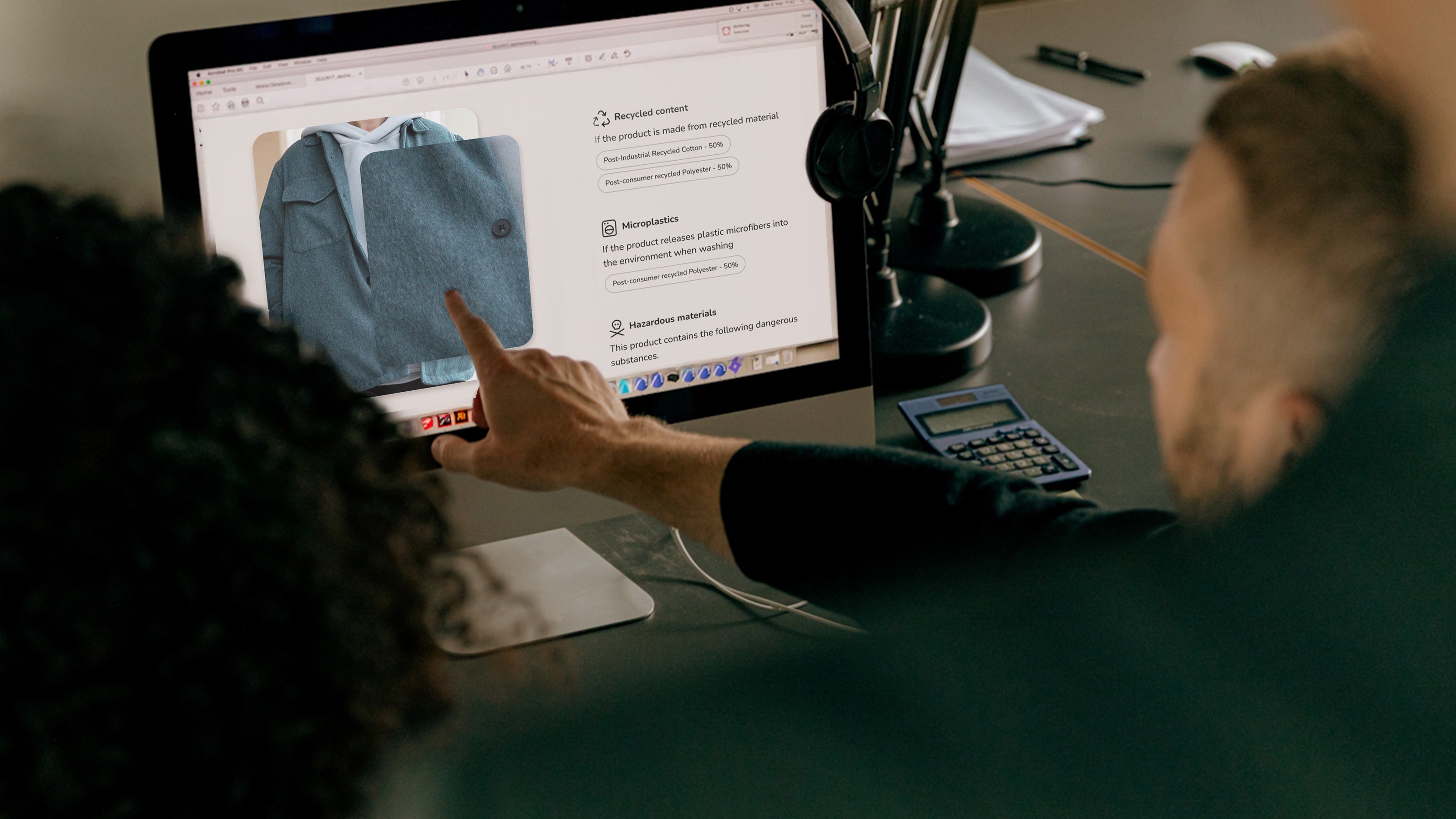

Nobody’s Child, a London-based fashion brand is a strong advocate and useful example in this respect. The brand has turned to Digital Product Passports (DPPs) as a viable tool to achieve both supply chain visibility and standardization, aiming for full rollout of DDPs by late 2025.

These passports provide detailed product information, including sourcing and sustainability data, accessible via scannable formats. The initiative has pushed the brand to trace its supply chain down to Tier 5, encompassing raw material origins.

It’s enabling a deep but manageable level of transparency that achieves two significant goals: It meets regulatory requirements, strengthens customer trust, and supports circular fashion initiatives like resale and repair.

Managing ESG Data Across the Value Chain: From Tier 1 to Raw Material Sources

Most fashion brands can collect ESG data from their Tier 1 suppliers. But ESG risks — especially social and environmental — are far more likely to occur deeper in the value chain, where transparency is thinnest. This is why leading brands invest in deeper traceability initiatives that push beyond Tier 1 and map suppliers down to the farm, mill, or raw material level.

A standout example is Kering. The luxury group has developed a sophisticated Environmental Profit and Loss (EP&L) tool that quantifies environmental impact across the full value chain — including upstream raw material sourcing, and ties that data to procurement strategy. This allows them to compare the environmental cost of sourcing from one region over another, shifting ESG data from passive reporting to active decision-making.

To achieve this level of granular visibility and control, companies are adopting digital product passports, blockchain platforms (like TextileGenesis, used by H&M Group), and supply chain mapping tools that assign traceability scores to each node in the chain. These technologies provide visibility and create verified ESG data trails that are tamper-proof and accessible across internal systems and stakeholders.

Improving Data Collection, Quality, and Consistency Across Brands and Suppliers

The biggest hurdle ESG managers face isn’t necessarily collecting data — it’s collecting good data. That means data that’s consistent across suppliers, conforms to accepted methodologies, and can be independently verified. Without this, sustainability reports lose credibility, and compliance risks multiply.

To close this gap, brands are rethinking how they structure supplier relationships. PVH Corp, for example, embeds ESG data requirements into supplier onboarding and performance contracts. Suppliers must use standardized tools (like the Higg Facility Environmental Module) and undergo regular third-party audits, with results feeding directly into PVH’s digital ESG platform.

Others, like Stella McCartney, partner with technology providers to link physical products with digital identities, enabling real-time tracking of materials, labor conditions, and certifications. This improves data quality and creates a transparent chain of custody that can be communicated to consumers and regulators alike.

Critically, improving ESG data collection also requires building supplier capacity. Many Tier 2 and Tier 3 suppliers lack the tools or training to generate high-quality ESG data. Brands like Nike have responded by investing in supplier ESG capability-building programs, offering training, software, and funding to help suppliers meet new disclosure requirements, ensuring that transparency doesn’t stop at the factory gate.

Key Takeaways

-

Standardization is crucial: Establishing uniform ESG reporting frameworks can alleviate supplier burden and improve data consistency.

-

Technology is a force multiplier: Embracing digital tools and AI can significantly enhance ESG data management capabilities.

-

Collaborative approach: Engaging suppliers as partners in the ESG journey fosters better data quality and compliance.

-

Strategic integration: Aligning ESG initiatives with core business strategies ensures sustainability efforts are impactful and enduring.

What’s Next for ESG Reporting in Fashion

As ESG reporting becomes more regulated, scrutinized, and central to business performance, fashion brands are entering a new era — one where data integrity isn’t a back-office task but a boardroom imperative. The pressure is real: the CSRD, California’s Climate Accountability Package, and growing investor demands are closing the window on half-measures and fragmented disclosures.

What comes next is clear: ESG data will need to move at the speed of business. That means end-to-end traceability, digital integration across global supplier networks, and shared metrics allowing faster, more informed decisions — from sourcing to marketing.

Leading fashion companies are already embracing this shift, not just to comply but to compete. They treat ESG data as a strategic asset, align reporting systems with financial risk models, and embed sustainability into core business operations. The message is simple for those still lagging behind: get ahead now, or get left behind later.

Done right, the future of ESG reporting isn’t just about compliance — it’s about control. Brands that build the proper infrastructure today will unlock new forms of value tomorrow: lower operational risks, stronger stakeholder trust, and a supply chain that can withstand whatever comes next.